As family businesses grow and evolve, leadership transitions become critical moments in their journey. Part 1 - The Family Business Journey explored the foundational principles of family business governance and the interplay between ownership, family, and business priorities. In this continuation, we focus on succession planning, a cornerstone of effective corporate governance, and how it shapes the sustainability, resilience, and long-term success of family enterprises.

Succession Planning: More Than a Contingency Plan

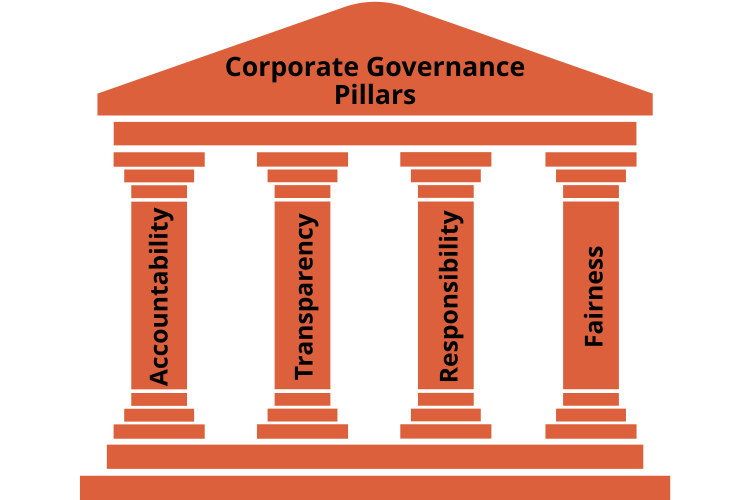

Succession planning involves strategically identifying and preparing individuals to assume key roles within an organisation, particularly at board and senior management levels. Corporate governance provides the structure, rules, and processes by which a company is directed and controlled. Succession planning is a critical governance issue because it ensures continuity of leadership, aligns management with the company’s strategy, and protects shareholders’ interests.

Key governance considerations in succession planning:

Board Responsibility: The board is responsible for overseeing the succession process to prevent favoritism, ensure merit-based selection, and align leadership with long-term strategy.

Transparency: Clear policies on how successors are chosen help prevent disputes among stakeholders.

Accountability: Management and the board must be accountable for planning and implementing leadership transitions responsibly.

Fairness: All potential candidates should be evaluated based on objective criteria, preventing bias toward family members, insiders, or dominant shareholders.

Key Benefits of Succession Planning for Family Businesses

Optimised Board Composition

Establishing a board with the right mix of skills, experience, and independence ensures effective governance and strategic oversight. In family businesses, balancing family members with independent non-executive directors strengthens decision-making and reduces the risk of governance gridlock.Preparedness for Leadership Transitions

Clear succession plans allow swift and effective replacement of key executives, minimising disruption to operations and stakeholder confidence.Talent Development and Retention

By identifying and nurturing internal talent, family businesses prepare the next generation of leaders while enhancing employee engagement and retention.Diversity and Inclusion

Actively seeking diverse candidates introduces broader perspectives and promotes innovative decision-making – a key differentiator for family businesses facing complex, multi-generational challenges.Board Refreshment

Regularly reviewing and updating board composition prevents stagnation and encourages the infusion of new ideas, supporting growth and adaptability.Enhanced Resilience

Staggered leadership changes, knowledge transfer, and mentoring programmes strengthen organisational adaptability and reduce the risks associated with sudden departures.Investor Confidence

Demonstrating a proactive approach to succession planning reassures investors, lenders, and other stakeholders of the business’s long-term stability and governance quality.Informed Remuneration Decisions

Insights from performance evaluations support competitive and fair remuneration offers, helping attract and retain top talent.

Tailored Approaches for Executive and Non-Executive Roles

Succession planning strategies differ significantly between executive and non-executive positions:

Executive Roles:

Focus on identifying internal candidates familiar with the company’s culture, operations, and strategic vision. Contingency plans are essential for sudden departures to maintain continuity.Non-Executive Roles:

Typically filled through external executive search professionals, these positions bring independent perspectives and expertise. Planning ensures the board maintains an appropriate balance of skills and independence, which is particularly important in family-run firms where ownership and family influence can dominate decision-making.

Governance Challenges Unique to Family Businesses

Family businesses face a distinct set of challenges when implementing succession planning:

Founder’s Dilemma

Founders may struggle to relinquish control, associating the business’s success with their personal identity. This can delay planning and complicate leadership transitions.Intergenerational Dynamics

Power-sharing conflicts among siblings, differing visions, and alignment on strategic direction can challenge second-generation leaders.Third Generation and Beyond

As the business expands, multiple stakeholders and competing interests increase the risk of governance gridlock. Without formalised structures such as family councils or governance charters, succession may be hampered, risking business continuity.Informal Practices

Many family businesses rely on informal decision-making, which can leave succession plans untested, unstructured, or unclear to potential successors.Cultural and Emotional Factors

Emotional attachments, family traditions, and loyalty considerations often influence leadership decisions, adding complexity to succession planning.

Regulatory Considerations in Malta

While succession planning is legally mandated for regulated entities in Malta under the Malta Financial Services Authority (MFSA), unregulated and unlisted family businesses are not required by law to implement formal succession plans. However, adopting structured governance practices enhances business resilience and long-term viability. Regulatory frameworks emphasise that effective succession planning should:

Ensure leadership continuity.

Align board composition with governance best practices.

Mitigate risks associated with sudden or unplanned leadership departures.

Practical Steps for Effective Succession Planning

Successful succession planning in family businesses involves several interconnected steps:

Assessment of Current Leadership and Skills

Understand the capabilities, gaps, and potential of current leadership to identify internal successors or external needs.Future-Focused Planning

Establish clear criteria for successor selection, including qualifications, competencies, and alignment with strategic goals.Development Programmes

Implement mentoring, coaching, and leadership development initiatives to prepare future leaders for their roles.Governance Structures

Formalise family councils, advisory boards, and governance charters to separate ownership influence from operational decision-making.Communication and Transparency

Maintain open dialogue with family members and stakeholders to align expectations and reduce conflict during transitions.Monitoring and Review

Succession plans should be dynamic, reviewed periodically, and updated to reflect changing business needs and family dynamics.

Strategic Benefits of Effective Succession Planning

By integrating succession planning into governance, family businesses gain:

Continuity Across Generations: Smooth transitions ensure the organisation maintains strategic focus.

Enhanced Reputation: Demonstrates professionalism to investors, partners, and employees.

Sustainable Growth: Ensures the next generation is equipped to drive innovation and growth.

Conflict Mitigation: Reduces disputes by clarifying roles, responsibilities, and expectations.

Succession planning transforms leadership change from a potential crisis into a strategic opportunity, enabling family businesses to thrive across generations.

How AIMS International Can Help Family Businesses

Family businesses can benefit greatly from expert guidance in succession planning. AIMS International provides tailored support to help these enterprises:

Assess leadership capabilities and identify potential successors.

Design structured governance frameworks that balance family influence with professional oversight.

Develop mentoring and coaching programmes to prepare future leaders.

Facilitate discussions among family members to align objectives, values, and expectations.

Ensure smooth transitions that safeguard the business legacy while maintaining operational continuity.

By partnering with experienced advisors, family businesses can implement succession plans that are robust, future-proof, and aligned with their strategic goals.

Conclusion: Steering the Family Business Successfully

Succession planningis not a mere procedural exercise; it is a strategic imperative that safeguards the future of family businesses. By proactively preparing for leadership transitions, family firms can ensure operational continuity, develop internal talent, and uphold strong governance practices.

Whether formalised due to regulatory requirements or implemented proactively to secure legacy and growth, succession planning is central to steering family businesses effectively. As these enterprises navigate the complexities of generational change, clear governance, structured planning, and thoughtful leadership development are the compass that ensures they remain resilient, innovative, and successful.

👉In a subsequent article, we will discuss the interplay between family conflicts and succession planning.

"Every decision we make today ripples into the future. Strong governance and thoughtful succession planning allow those ripples to become waves of lasting impact. Leadership is not just about presence—it’s about preparing others to lead when we step aside."— Louise Vella, Managing Partner @ AIMS International Malta

This article is part of a six-part series on Succession Planning, created to help family businesses plan confidently for leadership transitions. Look out for the next piece in the series.

Sources and further reading

Malta Financial Services Authority (MFSA). (2020). Corporate Governance Guidelines for Regulated Entities.

Tribolet, H., & Wielsma, A. J. (2025). Stabilizing a family business: The transformation of governance mechanisms in times of change. Journal of Management History, 31(1), 45–63.

Davis, J. A., & Tagiuri, R. (1982). Bivalent attributes of the family firm. Working Paper, Harvard Business School. (Reprinted 1996, Family Business Review, 9(2), 199–208).

About the Author

Louise is a seasoned professional with over 25 years of experience in the Corporate Services Provider (CSP) industry. She has supported a wide spectrum of clients, including those from the corporate, private, and public sectors, as well as entrepreneurs, across various aspects of company secretarial work, corporate governance, trustee, directorship services and risk management.

How Can I Help You Preserve Your Family Legacy?

Unlike larger corporations that adhere to clearly defined pathways guided by EU directives and governance frameworks, family businesses often navigate intricate routes shaped by tradition, emotional considerations, and close personal relationships. Consequently, succession planning represents one of the most formidable challenges that any family business will encounter.

I'm happy to share insights and provide you with a solution that meets the specific needs of your family business.